Miles Reimbursement 2024 California

Miles Reimbursement 2024 California. 67 cents per mile driven for business use, up 1.5 cents from 2023. What are the rules for mileage reimbursement in california?

California follows the irs standard mileage rates, with the 2024 rate set at 67 cents per mile. 21 cents per mile driven for medical or moving purposes for qualified.

Operate A Privately Owned Vehicle On State Business.

The 2024 irs mileage rate is as follows:

A Firm Grasp Of Reimbursement Rates, Eligibility Criteria, And.

Here’s a breakdown of the current irs mileage reimbursement rates for california as of january 2024.

Miles Reimbursement 2024 California Images References :

Source: soniaqcarline.pages.dev

Source: soniaqcarline.pages.dev

2024 Mileage Reimbursement Rate California Idalia Friederike, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,. Learn how the irs rate and other rules apply in the golden state.

Source: lelaheolande.pages.dev

Source: lelaheolande.pages.dev

California Mileage Reimbursement 2024 Leah Sharon, Learn how the irs rate and other rules apply in the golden state. The standard reimbursement rate for 2024 is currently set to 67 cents per mile, which is 1.5 cents higher than it was for 2023, when it stood at 65.5 cents per mile.

Source: lorraynewdorthy.pages.dev

Source: lorraynewdorthy.pages.dev

Mileage Reimbursement California 2024 Regan Charissa, Since january 1st, 2024, the irs standard mileage rate has been.67 cents per mile. The standard mileage rate for business use is set at 67 cents per mile in 2024.

Source: aileqmorganne.pages.dev

Source: aileqmorganne.pages.dev

Ca Mileage Reimbursement Rate 2024 Emmi Norine, The standard reimbursement rate for 2024 is currently set to 67 cents per mile, which is 1.5 cents higher than it was for 2023, when it stood at 65.5 cents per mile. 21 cents per mile driven for medical or moving purposes for qualified.

Source: audiqdiane-marie.pages.dev

Source: audiqdiane-marie.pages.dev

Reimburse Mileage Rate 2024 Aidan Arleyne, The standard mileage rate for business use is set at 67 cents per mile in 2024. California minimum wage 2024 by city 2024 fern orelie, so if one of your employees drives for 10 miles, you would reimburse them $6.70.

Source: elizabamandie.pages.dev

Source: elizabamandie.pages.dev

Current Irs Mileage Rate 2024 Forecast Velma, Discover california's mileage reimbursement in 2023 and 2024, including laws, methods, and essential tools for calculation. What is the california state law on mileage for jobs?

Source: aileqmorganne.pages.dev

Source: aileqmorganne.pages.dev

Ca Mileage Reimbursement Rate 2024 Emmi Norine, On december 14, 2023, the agency announced the following rates for 2024 business travel: Find information about the types of mileage reimbursement in california, the 2024 california mileage rates and the records you'll need to keep to be reimbursed.

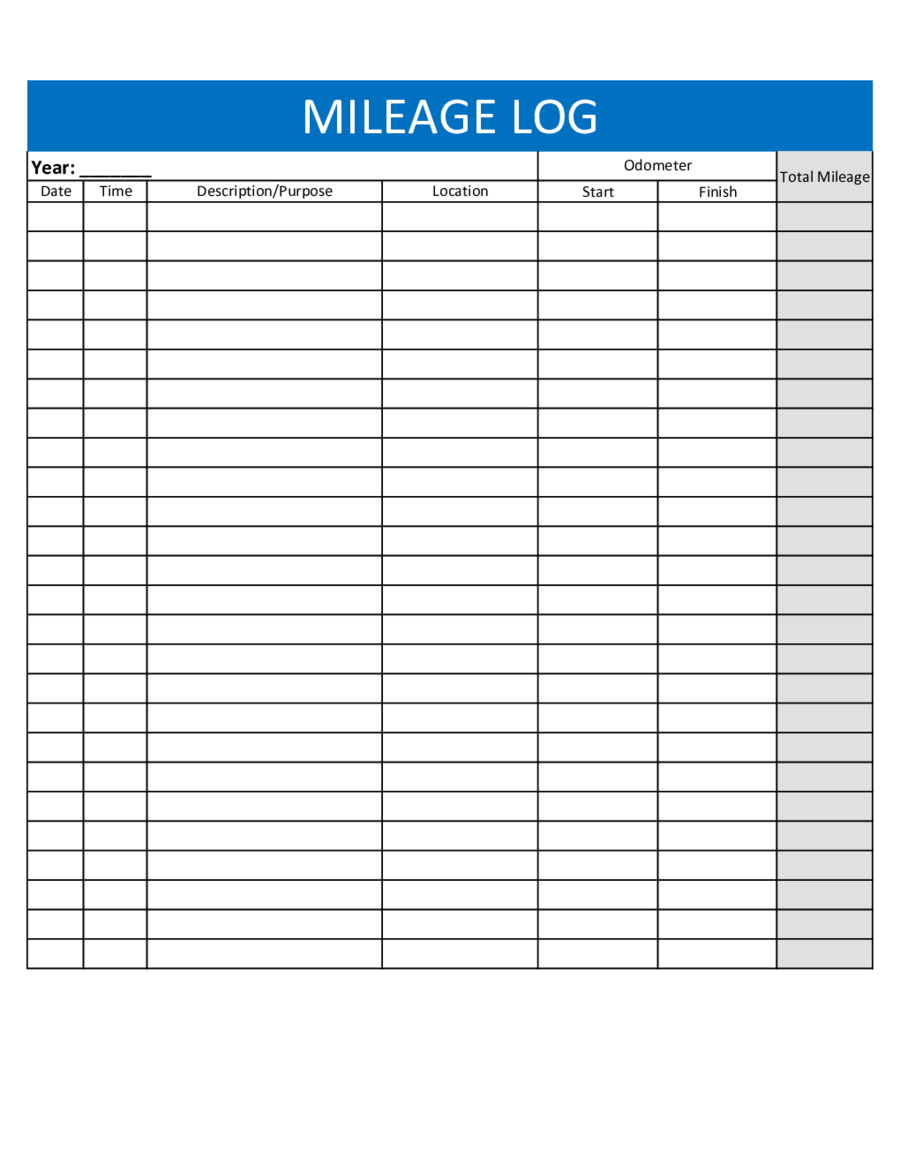

Source: www.pinterest.com

Source: www.pinterest.com

This mileage reimbursement form can be used to calculate your mileage, 21 cents per mile driven for medical or moving purposes for qualified. When determining how to reimburse an employee for use of their personal vehicle, employers may select between different methods for reimbursement including actual.

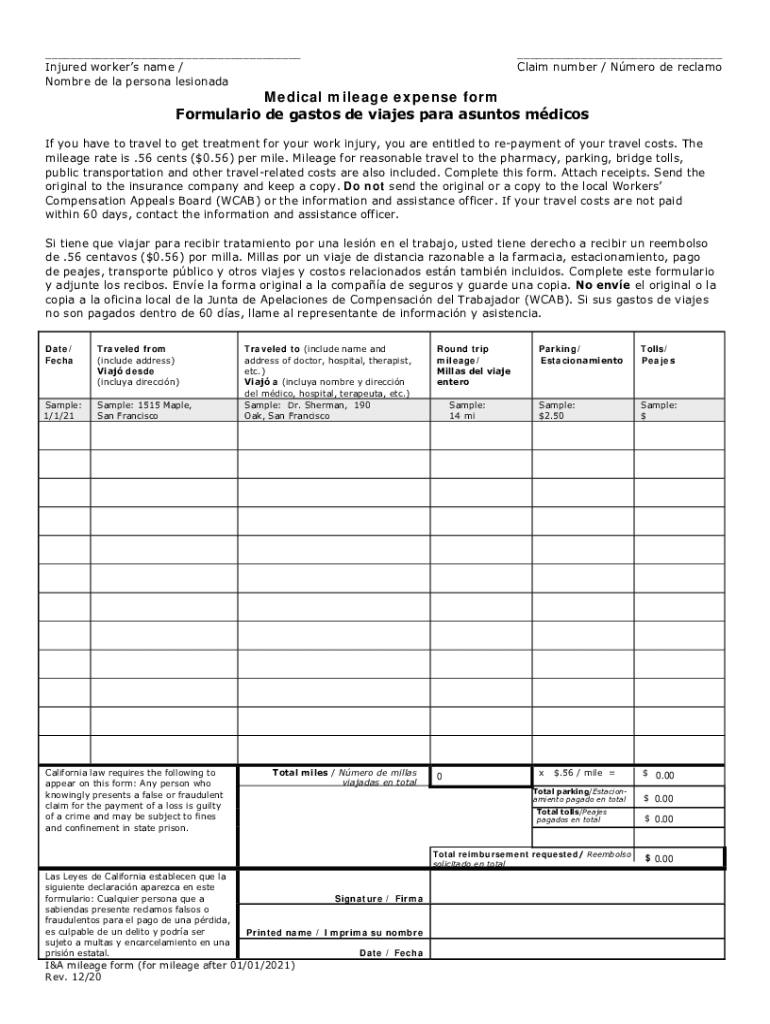

Source: www.dochub.com

Source: www.dochub.com

California mileage verification form Fill out & sign online DocHub, 21 cents per mile driven for medical or moving. The mileage reimbursement is for the use of cars such as vans, pickups,.

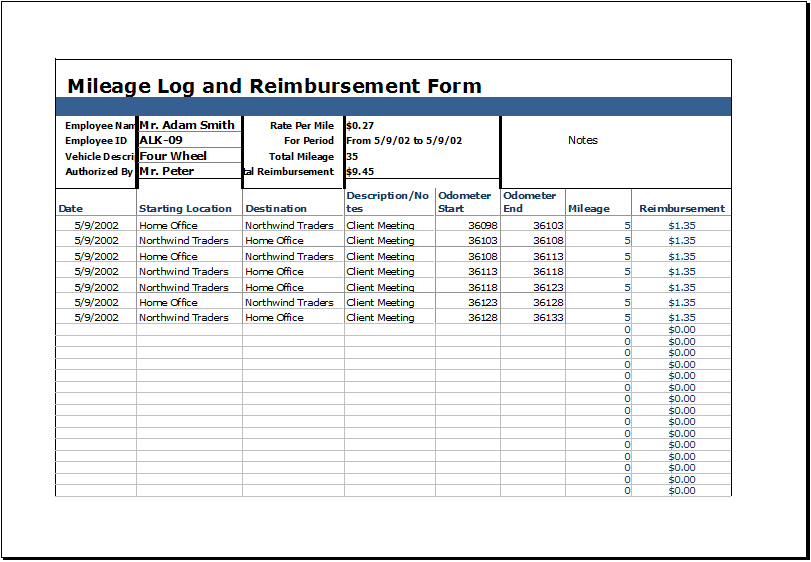

Source: nertiherminia.pages.dev

Source: nertiherminia.pages.dev

Mileage Reimbursement 2024 Form Excel Esta Alexandra, Operate a privately owned vehicle on state business. On december 14, 2023, the agency announced the following rates for 2024 business travel:

67 Cents Per Mile Driven For Business Use, Up 1.5 Cents From 2023.

Mileage reimbursement in california is a practical and essential aspect of the state's employment landscape.

67 Cents Per Mile Driven For Business Use.

Employees may claim reimbursement for mileage expenses when they are authorized by their appointing authority to:

Posted in 2024